Assuming you’ve already created a login to access our free course – How to Invest in Mortgage Notes, then this article will be a valuable supplement in your journey to building a portfolio of performing notes for passive income cash-flow & non-performing mortgage notes for higher returns & the potential to acquire deeds.

The first step to buying a single mortgage note or portfolio of assets is to define your investment objectives, risk tolerance & source/amount of capital to deploy. Although many investors struggle from “analysis paralysis” and hesitate to make their first purchase, others jump in without a fully baked strategy. Either way, we’re here to help you take the next step to building your note portfolio!

Deciding your Mortgage Note Investment Strategy

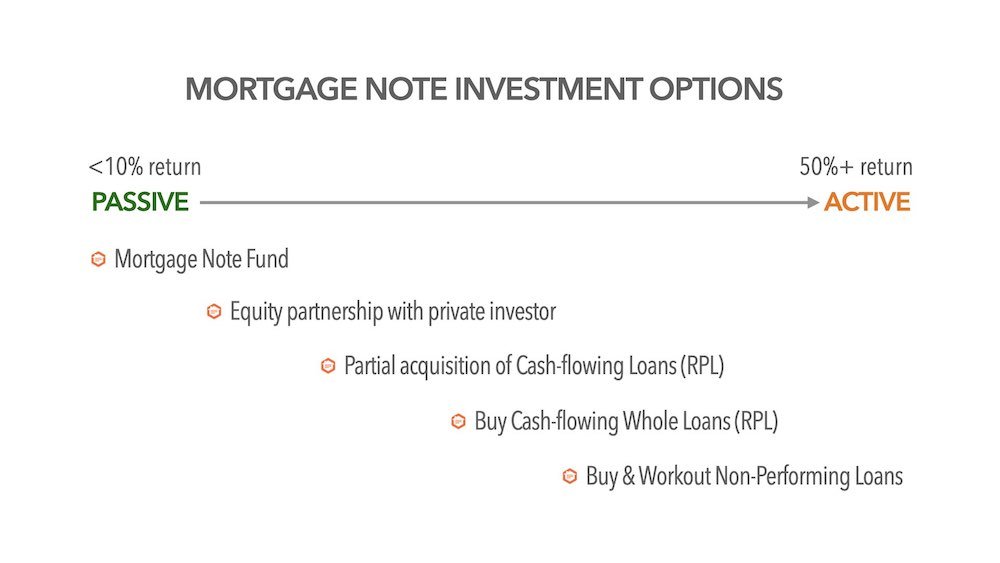

There are many ways to invest in mortgage notes from more passive options like note funds or equity partnerships or the most active strategy of buying & working out non-performing loans. Here is an overview of some of the ways you can invest in notes, we discussed these various options in episode #30 of our live YouTube series be.the.bank:

Passive Note Investing Options for Easy Cash-Flow

Although not technically buying a mortgage note, since you are not in complete control of the entity that will be recorded on title as the owner (through the Assignment of Mortgage process), investing in a Mortgage Note Fund will let you diversify across a larger portfolio with a smaller investment. Similar to an equity partnership with a private investor, this type of note investment will let you leverage the expertise of a more experienced investor.

Some of our favorite Mortgage Note Funds for passive investors are Aspen Funds & PPR.

To meet experienced investors working on equity partnerships, join the Mortgage Note Mastermind.

Active Note Investing Options for Higher Returns

The focus of the rest of this article is focused on active note investing strategies for higher returns. Although we consider Partials & Re-Performing Loans (RPLs) to be an active investment in notes – if you do your due diligence and servicing transfer correctly, the hard work will be completed upfront to ensure long-term passive income from your cash-flowing notes with limited on-going efforts required.

Buying non-performing notes on the other hand, offer the highest returns but also require the most amount of work. Non-performing loans (NPLs) can be a more risky investment if you make any mistakes in your due diligence process. Let’s start by reviewing the process to buy cash-flowing notes.

How to Buy Performing Notes

Cash-flowing mortgage notes that are traded on the secondary market are generally Re-Performing, they were once in default but the borrower is back on track, typically after signing a modification agreement. Performing notes that are paying as-agreed with no default are also sometimes available for sale but are most likely privately-originated loans (often seller-financing) and are not from institutional sources. Performing, institutionally-originated loans are pretty much exclusively sold to other large institutional buyers for the highest prices (as Jorge Newbery explains here).

The first thing to do when you are offered a Cash-flowing Note for sale

Before we get into the important steps of finding & vetting sellers and completing your full due diligence process, you’ll want to remember this valuable tip for when a seller sends you a loan for sale so you can reply to them quickly & get the ball rolling. You’ll want to keep your sellers happy so they think of you first when they have loans for sale!

In order to avoid wasting your seller’s time when they send you a potential asset to purchase there are a few things you can do in less than 5-10 minutes to determine whether you want to proceed with the trade:

- Run your model to calculate the expected cash-on-cash & internal rate of return

Your pricing model doesn’t have to be complicated. In fact, you can easily check the cash-on-cash return with this simple formula: ((monthly P&I payment – servicing fee) * 12) / asking price.

If the seller has provided you with an asking price, this easy calculation will let you know right away if the investment fits your objectives for a decent return. For re-performing senior liens, expect between 8-14% returns or for junior liens, 12-18% annual returns. Don’t forget to also check the internal rate of return (IRR) to make sure the longer-term yield hits your targets (this case-study explains how to calculate IRR in more detail).

If an asking price is not provided, you can use the above cash-on-cash and IRR calculation in reverse to calculate the price you would need to pay in order to hit your desired return. For example, if the note is paying $500 per month and you want to earn 15% on your money, you would calculate as follows (assuming a $20 per month servicing fee)

($500 – $20)*12 = $5,760 annual income / .15 = $38,400 purchase price

2. Confirm the loan is secured

Assuming the return on investment is acceptable, the next step you can quickly complete to ensure the asset is a viable investment is a secured scrub. Basically, this means checking to see that the borrower (mortgagor) is the owner of the property. This is completed by checking the public ownership records for the subject property. You can learn more about Secured versus Unsecured in Episode #22 of be.the.bank (this is also a critical step for non-performing note due diligence).

3. Reply with an indicative offer subject to complete due diligence

Whether your ROI calculations and secured scrub were successful or not, it’s important to reply to your seller right away with your initial findings. With a little practice, these indicative steps will take you less than 10 minutes and the quick turnaround will be impressive and helpful to your seller and ensure they send you more deals in the future. If the deal doesn’t fit your model – tell them why.

If your initial findings on the deal look good – then you’ll want to submit your letter of intent (LOI). With the right language, this indicative offer will set the stage for a successful acquisition while protecting you if your complete due diligence reveals anything bad about the loan. Learn more about how to write & send your LOI in module #8 of the free course: How to Make a No-Risk Bid (you’ll need to create a login to access this lesson).

How to buy Non-Performing Notes

Before we get to the steps in the mortgage note acquisition process that overlap for both cash-flowing and non-performing loans, let’s look at a few nuances of buying non-performing loans (NPLs). There are a few main differences when purchasing non-performing 1st or 2nd position loans:

- NPLs are most often bought & sold in portfolios

Most sellers are looking for bulk buyers to purchase an entire portfolio of non-performing notes at once. Although you can also find one-off asset sales available on the secondary market, it is recommended to buy at least a few loans at once in order to diversify and spread your risk.

- Most NPLs enter the secondary market after being charged-off by a institutional lender

The “secondary mortgage market” is simply the buying & selling of loans after they have been originated. This is a typical practice in the industry and performing loans are often sold immediately after origination. Non-performing loans on the other hand trickle down to smaller investors after first being charged-off by a big bank and then sold to larger hedge funds and private companies. The charge-off process is the bank’s accounting practice to write-off their “bad debt” before putting together a portfolio of these defaulted loans for sale to the market.

The Mortgage Note Acquisition Process

Now that we’ve reviewed the differences between cash-flowing loans and non-performing loans, let’s review the step by step process that every note acquisition follows. Read below for more information about each step of the process, or if you prefer to watch a video – follow along with a live portfolio management process in episode #38 of be.the.bank:

Step 1: Find & Vet the Loan Seller

There are many ways to find mortgage notes for sale: 3rd party exchange platforms, private note sellers and advanced techniques to find off-market deals owned by banks, credit unions and other motivated lenders. Learn more in our upcoming article Where to Buy Mortgage Notes.

Once you’ve found a note seller, the next step is to vet the company to ensure that you are dealing with a reputable counter-party. The particular asset(s) they are selling might look great but if the seller doesn’t follow-through with the transfer process following receipt of funds, you might be the victim of a scam or fraudulent transaction. Learn more about sourcing & vetting sellers in module #6 of our free course.

Step 2: Pre-Bid Waterfall Process

We’ve already covered one very important step of this process in the Performing Note section above (the secured scrub) but there are some other data points to gather in your initial research process prior to submitting your LOI, especially for NPLs, where there is more uncertainty. We cover the Pre-Bid Waterfall Process in complete detail in module # 7 of our free course.

Step 3: Submit the Letter of Intent

Once you’ve calculated your indicative offer based on your initial research, it’s time to send the seller your LOI. This letter will include your price, terms & timeline to closing. Make sure that if the seller accepts you are fully prepared to follow through with the deal! As mentioned above, more information on this step is covered in module #8: How to Make a No-Risk Bid

Step 4: Complete Full Due Diligence

After the seller agrees to the terms of your offer – you’re ready to complete your full due diligence. Up until this point, you have been able to do all of the research on your own using free resources & public information. Now that the seller has agreed to the deal (exclusivity), you can spend some money on property valuation, title, credit, etc. For the complete instructions, see module #9: Advanced Due Diligence – and don’t forget to complete the 6 sub-lessons for property value, bankruptcy, occupancy/skip tracing, title reports, property taxes and credit reports.

Step 5: Finalize the Offer

Now that you know everything there is to know about the asset(s), it’s time to firm up your bid. As soon as you have all the information you need to get comfortable with the purchase – let the seller you’re ready to move forward, negotiate the price or cancel the deal based on your findings. As long as you provide evidence for your decision to renegotiate or kill the deal, they should understand your reasoning. Learn more about how to negotiate the final price and finalize your offer in module #10 of the course.

Step 6: Review the Contract

Most sellers use a pretty standard contract but it’s critical to understand these terms. Other than the more self-explanatory details like closing & collateral/servicing transfer date, the most important factors are the cut-off date (the date payments received by the borrower are now owned by the buyer), the representations, warranties & remedies (the seller’s promises and how to resolve issues) and the final claim date (the deadline for notifying the seller about an issue that needs to be corrected. For an example contract, review the standard Mortgage Loan Purchase Sale Agreement in Module 11.

Step 7: Fund the Trade

If the contract is satisfactory, it’s time to wire the funds! Most note deals aren’t completed with a 3rd party escrow but for larger or first time deals, it may be part of your closing. In this case, you’ll send the funds to your escrow agent who has been instructed to release proceeds only after all collateral documents have been confirmed complete. In preparation of this step, refer to the Closing Checklist in module #12 of the course.

Step 8: Coordinate Servicing Transfer

Following receipt of funds, it’s the seller’s responsibility to arrange with their loan servicer to transfer servicing to your servicer of choice. Most note transactions are completed on a “service-released” basis but some sellers will allow you to maintain the servicing with the current company. Either way, the seller will need to inform their loan servicer on the sale & get the transfer initiated. Around the same time as you send the purchase proceeds wire, you should also provide the seller with your loan servicer information & collateral delivery address. A good seller will also send you images of the Assignment of Mortgage and Allonge (or endorsement) to the Note for your confirmation.

For all the information the seller will need for the transfer, see module #13: Seamless Servicing Transfer.

Step 9: Review the Collateral Docs + Record your Assignment

Normally within a month of funding, you (or your collateral custodian) will receive a shipment of documents. If all is in order, this file will contain the Note, Mortgage, Allonge & Assignment. Review these documents carefully, in the note business this is what you are paying for – the paperwork! Recording the Assignment in the local county records is a critical step to ensure you receive notices & the borrower or a title company knows who to pay off! For examples of these documents and more information, see module #14: Auditing the Collateral Docs.

Step 10: Begin Portfolio Management + Collections

You’ve done it! You’ve close a note deal! Servicing is now with the company of your choice, collateral is complete & enforceable and your company name is on title via the recorded Assignment of Mortgage. The next step for performing loans is to confirm the first monthly payment and beyond are successfully received and for non-performing loans you need to begin your collection process. See module #15 for your High-Level Servicing Strategy, module #16 for Proactive Portfolio Monitoring (important for both performing & non-performing loans) and module #17 for the good stuff: Advanced Resolutions.

For continued reading, you’ll want to learn more about all of your exit strategies:

Thanks for reading, let me know if you have any questions!