In episode #2 of be.the.bank (two case studies per video) we took a look at a discounted payoff with our borrower to settle a non-performing 1st position mortgage note secured by a single family residential property. We always strive to create a win-win-win resolution. In this case, the bank was able to sell-off a defaulted loan, our borrower settled their debt at a discount and our investor made a 60% internal rate of return on their money!

| Fair Market Value | $40,000 |

| Delinquent Taxes | $1,384 |

| – Equity | $38,616 [154% CLTV] |

| UPB | $60,038 |

| Purchase Price | $20,000 |

| – % of Equity | = 51.8% |

| – % of UPB | = 33.3% |

| Exit Amount | $30,000 [42% IRR] |

purchased March 2019 & exited May 2020 = 14 months

Non-Performing Mortgage Note Resolution

When we’re able to get in touch with our borrower, the resolution process always begins with the three questions below. We explore this important conversation in depth in the Advanced Resolutions module of our free course.

- What happened?

- Where are you now?

- What do you want to do?

When we have the answers to these three questions, we’re able to act as problem solvers and put together a positive work-out. Our first communication with the borrower was through their legal counsel. They hired an attorney to review our initial offer to release our lien for $46,200 (~77% of the balance owed). This pre-approved settlement offer was calculated based on the details we could gather from the MLS – the borrower failed to sell the property for $50k in 2016 – two potential sales at this price fell through.

After discussing with their attorney, we received a counter-offer of $25,000 with some additional information about the rural property – there are environmental concerns to be addressed with the EPA and there is a dilapidated out-building that will most likely need to be demolished (photo evidence available).

After a bit of back-and-forth we settled on a $30k settlement to release our lien and give the borrower a clean slate on their property. There was certainly the potential of a more aggressive collection strategy, including a demand letter and initiation of foreclosure but based on the timeline and expense expected to take the account through the legal process, a relatively quick lump-sum payoff was a more sensible exit strategy.

Internal Rate of Return and Investment Velocity

IRR, or internal rate of return is an important consideration for investors everywhere because it allows us to compare dollars now to dollars in the future – otherwise known as the time value of money. By annualizing your Return on Investment, IRR gives us a clear picture of the profitability of an investment that pays off today, next year or in installment payments over any period of time.

There are two easy ways to calculate IRR on the fly, one is a simplistic formula the other is a more sophisticated (but easy!) Excel formula. First the simple formula, which takes ROI and annualizes it:

((Exit Amount – Purchase Price)/Purchase Price)/(Months to Exit/12)

To use this case-study as an example:

((30,000-20,000)/20,000)/(14/12)=43% IRR

Although this method has it’s limitations and inaccuracies, it’s a great way to get a rough idea of the time-adjusted ROI for a lump-sum settlement. To calculate cash-flow over time with more accuracy, use the following formula in Excel:

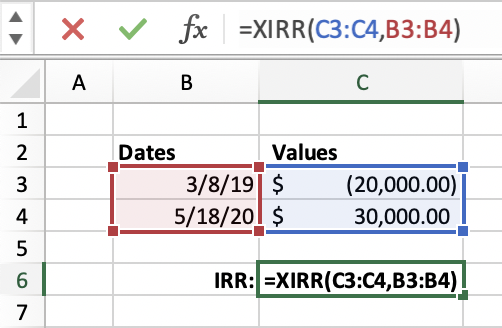

=XIRR(values, dates)

In order to run this formula, you will need a table with your payment outflows and inflows accompanied by their respective dates. It could be as simple as one outflow and one inflow:

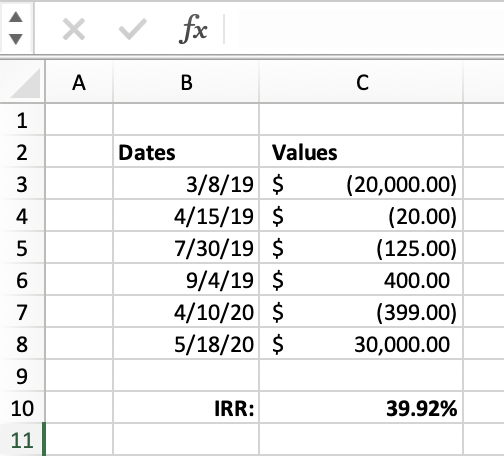

Or, you can include other income and expenses along the way – this is how you would calculate the internal rate of return for any type of regular or irregular cash-flow over a long period of time:

Calculating Internal Rate of Return is a valuable tool in the investor’s tool box and a critical calculation to maximize velocity. Essentially, a velocity approach to investing means keeping your capital deployed and working for you while making decisions to maximize your IRR. In this case study, we chose to accept a $30k payoff now instead of a higher payoff later. Instead of incurring legal fees and a lengthy foreclosure process, capital was returned quickly and can be put back to work – everyone wins!

See below for a time-stamped video presentation of this case study in episode #2 of our live YouTube series: be.the.bank

Comments