A Scalable System for Cash Flow & Growth – Without Using Your Own Capital

Now that you understand the different ways to profit from mortgage notes, it’s time to learn how to build your machine – a repeatable system that allows you to generate cash flow every month.

We call it the Note Investing Machine because, just like any well-designed system, it works for you, not the other way around.

But before we had this system in place, everything was trial and error.

At US Mortgage Resolution, where I learned the business and built my first Note Investing Machine, we spent $992,682.52 in mistakes, wasted time, and inefficient processes. We figured out how to build a Machine that actually worked. And once we did, it transformed into a system that has generated over $11,000 per day on average since 2011 – and $14,007 per day last year.

That’s why having a proven system matters.

And instead of spending years figuring everything out the hard way, in this module you’ll learn how you can shortcut your success by following a structured, step-by-step roadmap.

A Machine You Can Build One Piece at a Time

The beauty of this business is that you don’t have to build everything at once. You can start small, assemble the pieces as you go, and still make money along the way.

- If you start with sourcing deals, you can earn fees immediately by providing deal flow to other investors.

- If you later decide to acquire notes yourself, you can plug that into your machine.

- If you prefer a hands-off approach, you can focus on passive income from performing notes.

Think of each component of your machine like a LEGO brick. Whether you’re focusing on deal flow, pricing analysis, or servicing, you can snap each piece into place over time, customizing your machine to fit your goals.

And here’s the best part:

Every piece of your machine is also a potential profit center.

Even before you start investing your own money, you can generate cash flow by offering the same services you’ve built for yourself to other investors.

This is where the Mini-Agency Model comes in – allowing you to turn any part of your Note Investing Machine into a profit center.

Even before investing your own capital, you can get paid to provide essential services to other investors, including:

- Deal Sourcing & Lead Gen – Finding notes and sellers for active buyers.

- Acquisitions Management – Handling servicing transfers and deal logistics.

- Due Diligence & Pricing – Analyzing assets and structuring deals for investors.

- Asset Resolutions – Helping investors turn non-performing loans into profitable notes.

- Portfolio Monitoring & Servicing Oversight – Ensuring borrower payments stay on track.

- Marketing & Capital Raising – Helping investors attract funding and build their brands.

Whether you specialize in finding deals, analyzing assets, or managing loans, you can monetize your expertise immediately – earning while you continue building your own portfolio. I showed you in the last module how I made over $350,000 in 6 months by offering services like this to just a single client.

This means that even while you’re still assembling your machine, it can already start generating income for you.

Now as inspiration for your own Machine, let’s take a look at how we built this system, from scratch – and in the final Module of the Roadmap, I’ll show you how you can plug into the same proven system.

The Old Way: Trial & Error, Manual Work, and Constant Frustration

When we first started at US Mortgage Resolution, we had to figure everything out from scratch.

Every deal felt like reinventing the wheel because there was no system – just endless hours of research, testing, and fixing mistakes.

The result? $992,682.52 wasted on trial and error before we finally built a process that worked.

Here’s what every deal used to look like:

- No system for deal execution – Every note required a completely new strategy instead of following a proven model.

- Manual legal research – We had to document local foreclosure laws, servicing regulations, and licensing requirements from scratch for every new market.

- Inefficient pricing & analysis – Every note had to be manually evaluated with no standardized pricing model.

- Unstructured servicing process – We struggled through loan transfers and borrower negotiations without a clear workflow.

- Expensive legal overhead – Every contract, modification, and agreement required paying attorneys thousands of dollars in custom legal work.

This was slow, inefficient, and painful. It took years of trial and error and nearly $1 million in lost capital to finally create a repeatable system that worked.

That’s why we built the FIXnotes System – to eliminate the guesswork, standardize every part of the process, and ensure that no investor ever has to go through what we did.

The New Way: A Proven, Automated System for Success

Before, we were building everything from scratch – pricing models, legal templates, vendor relationships, and a repeatable deal process. It took years of trial and error to refine what worked and eliminate what didn’t.

Now, instead of approaching each deal as a one-off project, we rely on a standardized system that streamlines every part of the note investing process.

This system wasn’t built overnight – it’s the result of managing thousands of assets, learning from experience, and optimizing along the way. By having the right tools and processes in place, we’ve been able to scale our portfolio while reducing inefficiencies and risk.

So I’m going to give you an inside look at the system we developed to simplify and automate the key aspects of note investing.

Model Proven Deals Instead of Reinventing the Wheel

Most investors waste time figuring out a strategy from scratch for every deal.

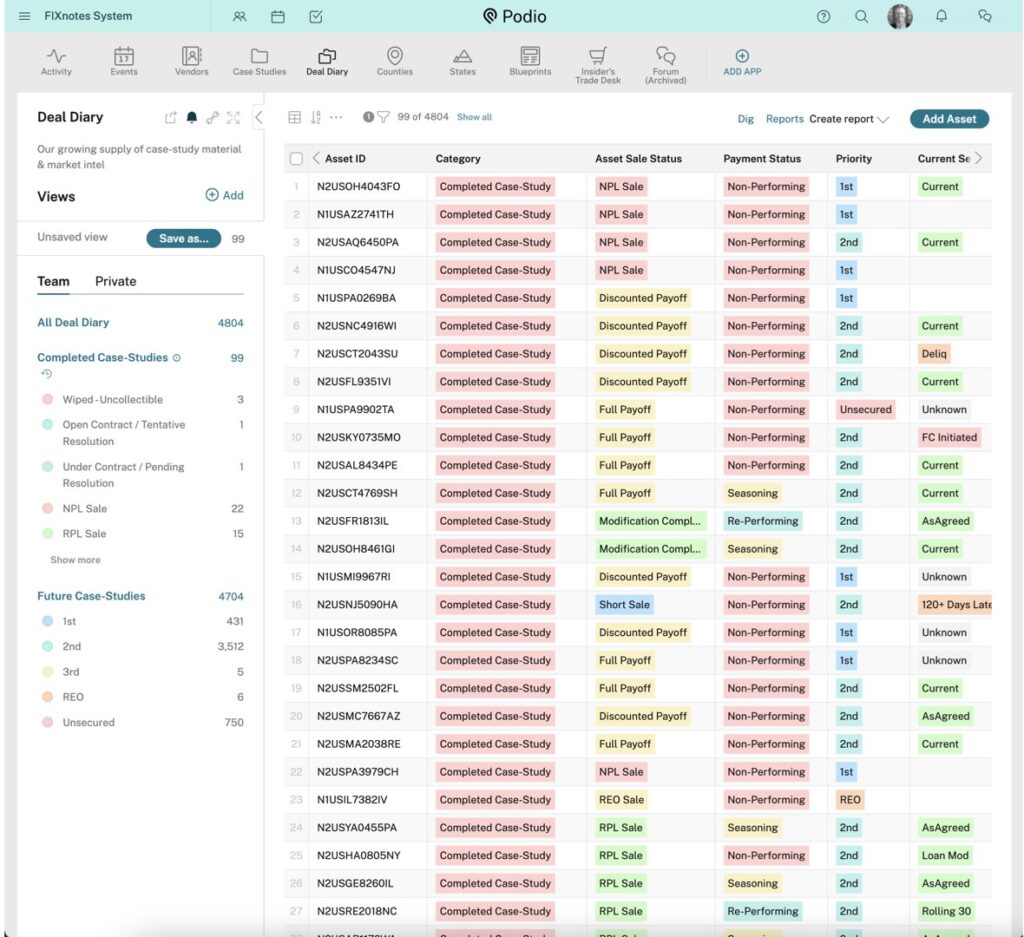

We built the Deal Diary – a database of nearly 5,000 completed note deals – so you can see exactly what’s worked before and model it for yourself.

With just a few clicks, we:

- Browse real case studies from deals we’ve closed – full settlements, discounted payoffs, short sales, loan modifications, REO sales, and more.

- Filter by asset type, market, and exit strategy to find examples that match your deals.

- Watch video breakdowns that explain exactly how each deal was structured – and how much profit was made.

Instead of guessing what might work, we follow what has already worked thousands of times.

Instantly Research Any Market Without Hours of Legwork

Researching legal requirements and foreclosure timelines used to be a time-consuming nightmare.

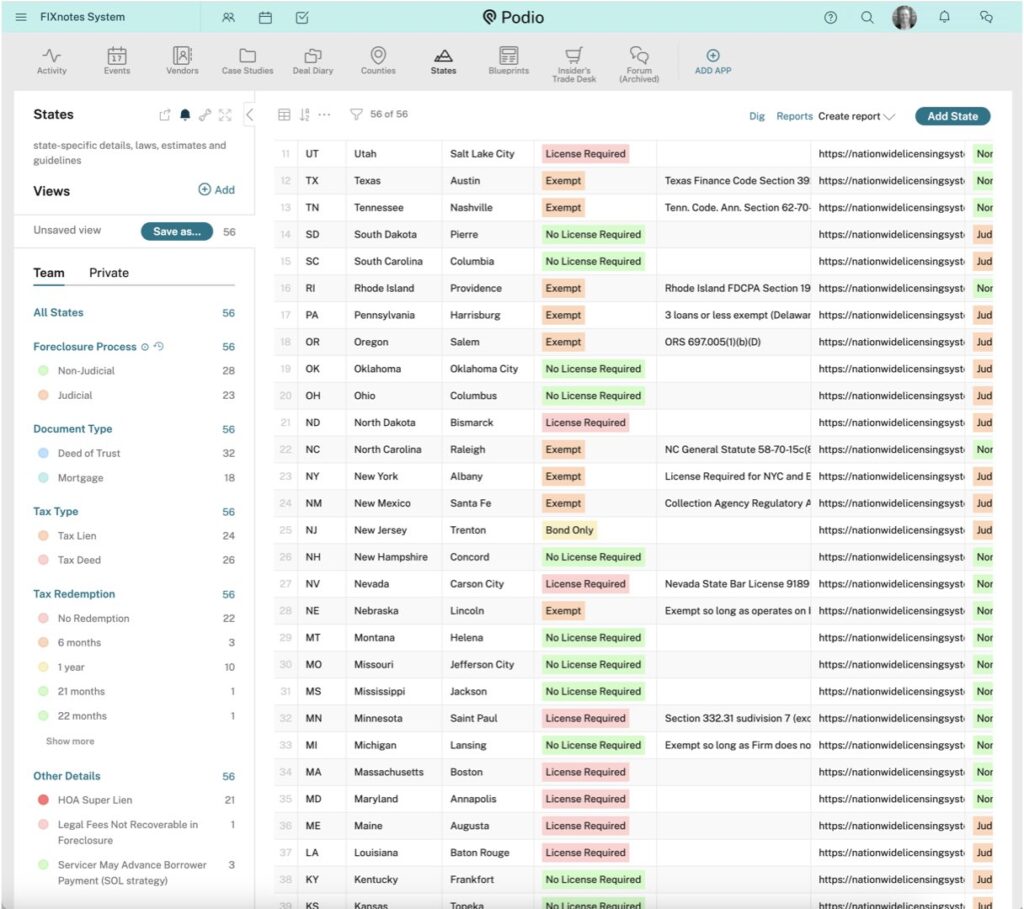

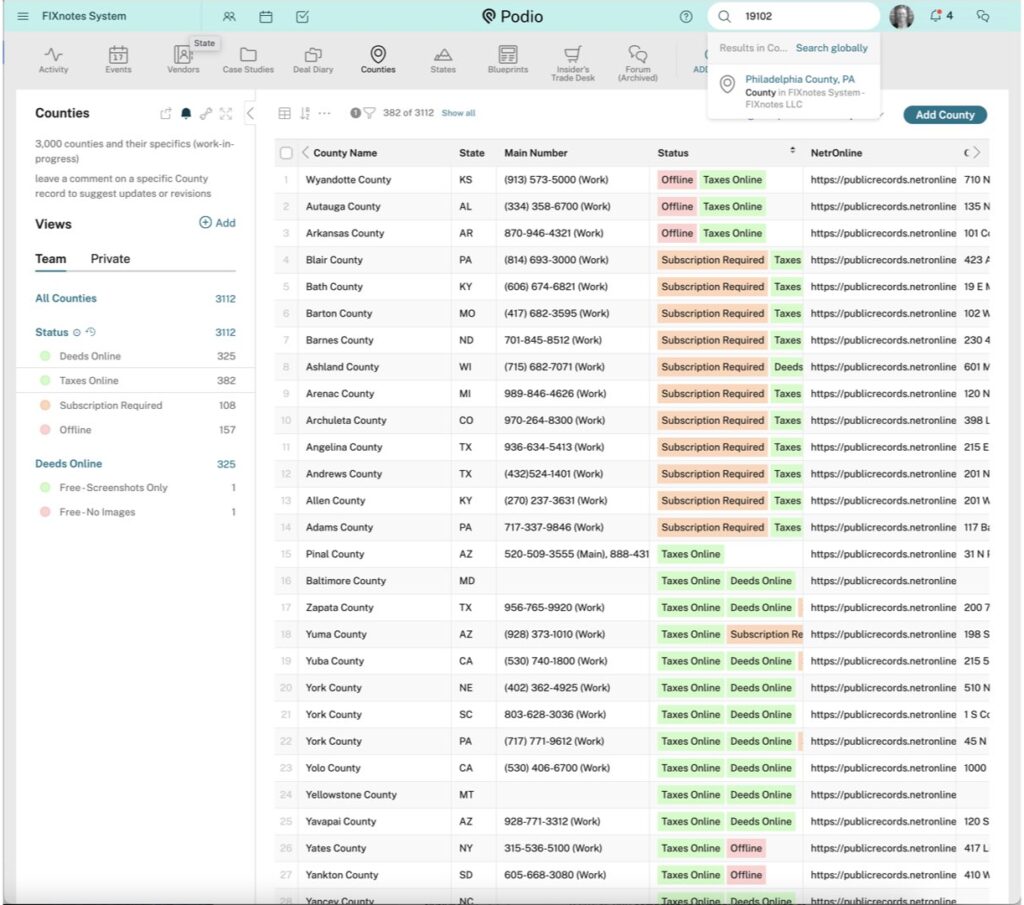

Now, with the FIXnotes state-by-state and county-by-county database, we pull up critical legal and market data in seconds.

For any state, we instantly get:

- Licensing requirements

- Judicial vs. non-judicial foreclosure process

- Estimated foreclosure costs and timelines

- Typical REO sale expectations

For any county, we get:

- Direct links to public records searches

- Property tax lookups

- Foreclosure case information

- and more important details

We just enter a ZIP code, and all the information is at our fingertips. No more wasted hours digging through different websites.

Automate Pricing & Due Diligence for Smarter, Faster Decisions

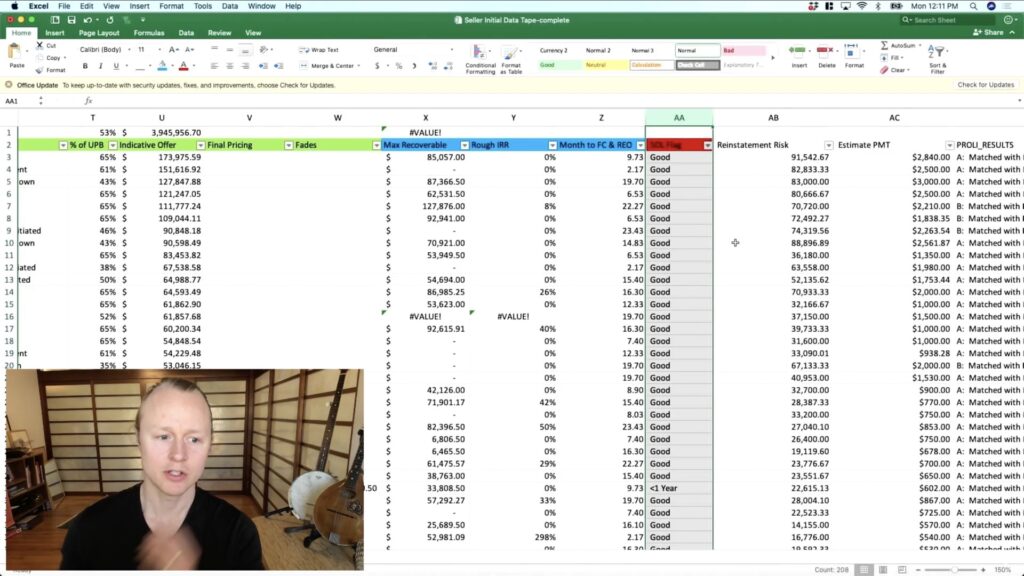

Pricing a note used to be inconsistent and time-consuming—requiring manual calculations and endless second-guessing.

Now, with our custom Pricing Model, we:

- Automatically calculate offer prices based on real market data.

- Account for risk factors like property condition, legal costs, and expected exit strategy.

- Generate a pricing report so you can make confident investment decisions.

Plus, we’ve created a complete Due Diligence Training where I’ve documented creating a Pricing Matrix step by step – the instructions to build a custom pricing model that can be used again and again, deal after deal.

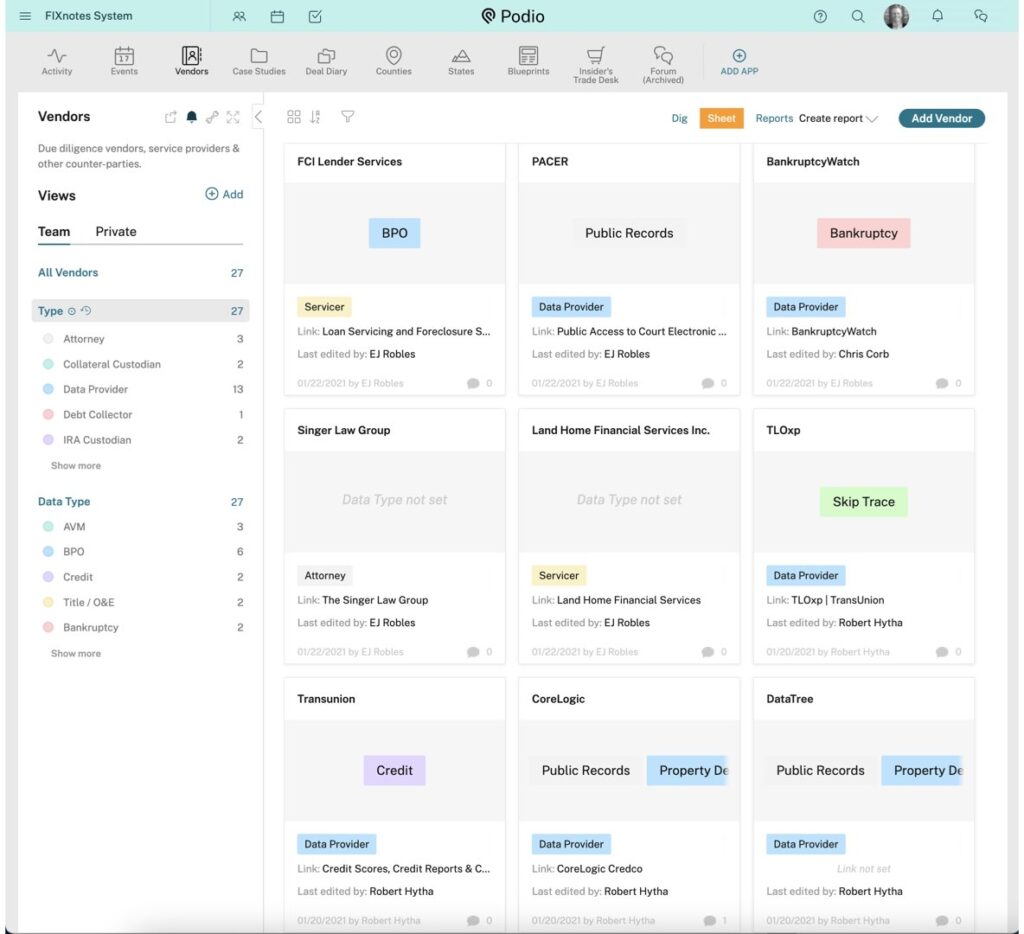

Work with Trusted Vendors Instead of Taking Risks

One of the biggest mistakes new investors make is working with unreliable vendors—costing them time, money, and deals.

With the FIXnotes Vendor Network, we’ve put together a vetted list of industry professionals for:

- Loan servicing

- Due diligence research

- Legal services

- Property preservation

Instead of trial and error, we work with trusted partners.

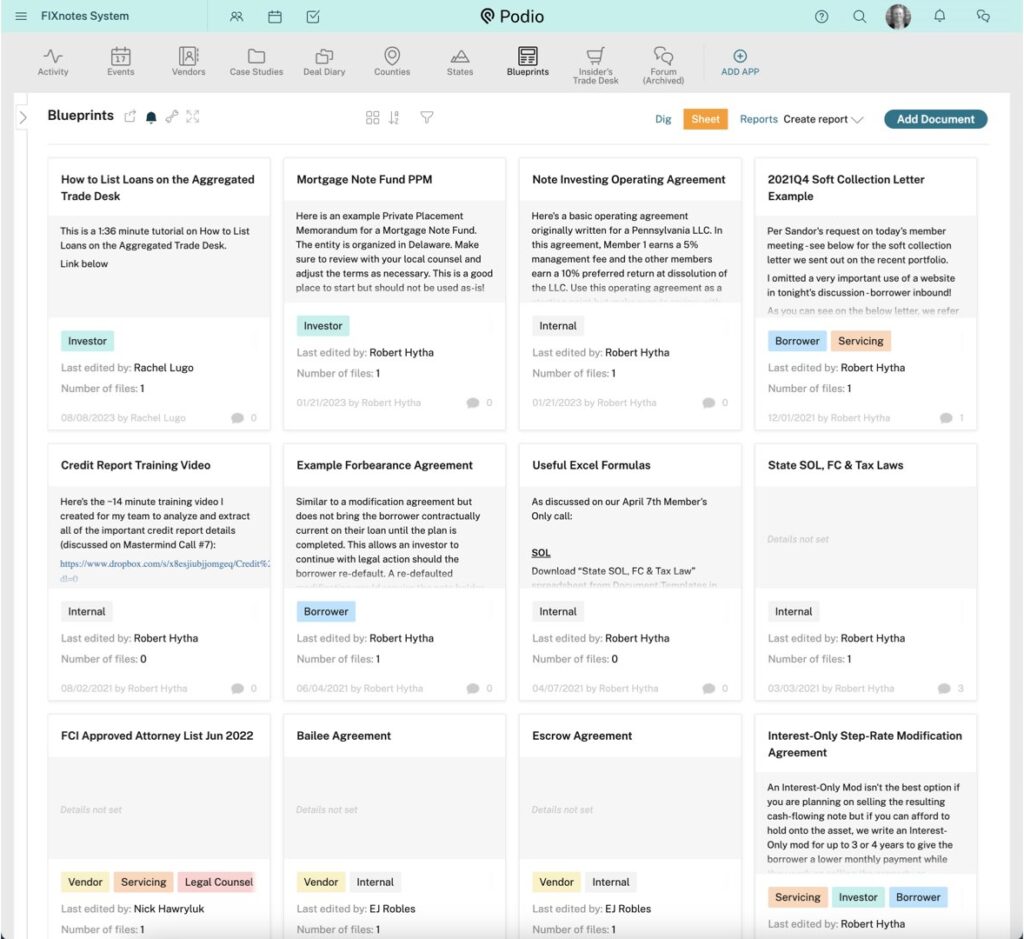

Use Proven Legal Documents Instead of Paying Attorneys Every Time

Legal contracts, servicing agreements, and loan modifications can cost thousands in legal fees if drafted from scratch.

That’s why we created the FIXnotes Blueprints – our collection of pre-approved, time-tested legal documents that have been refined over thousands of deals.

We’ve put together a collection of:

- Contracts and Agreements

- Letters and Documents

- Financial Calculators and Analysis Tools

- Templates, Tools & Resources

Instead of reinventing the wheel, we continue to use what already works – saving time, money, and stress on every deal.

Your Complete Note Investing Machine – Put it Together & Prepare to Scale

Instead of struggling through trial and error, we’ve systemized the entire process into a repeatable, proven system.

Here’s how your Note Investing Machine should work when built right:

- Model the successful deals we’ve already completed – so you always know what works.

- Search any ZIP code and instantly get market and legal data – so you don’t waste time on research.

- Plug new asset opportunities into your pricing model – so you always know exactly what to offer.

- Work with trusted vendors using a consistent, repeatable process – so you avoid bad partnerships.

- Use proven legal documents from our Blueprints – so you never have to start from scratch.

This is the roadmap to automating and scaling your note investing business.

Why Having a System Matters

Investing in notes requires managing multiple moving parts – from sourcing and analysis to servicing and legal oversight. Without a structured approach, it’s easy to get stuck in manual work, slow execution, and costly mistakes.

By using a proven system, every deal follows a repeatable process, making execution faster, more predictable, and more scalable.

Now that you see how each piece fits together, the next step is making sure your machine never runs dry.

In the next section, we’ll go over how to build a predictable deal flow system – so you always have high-quality note opportunities ready to go.

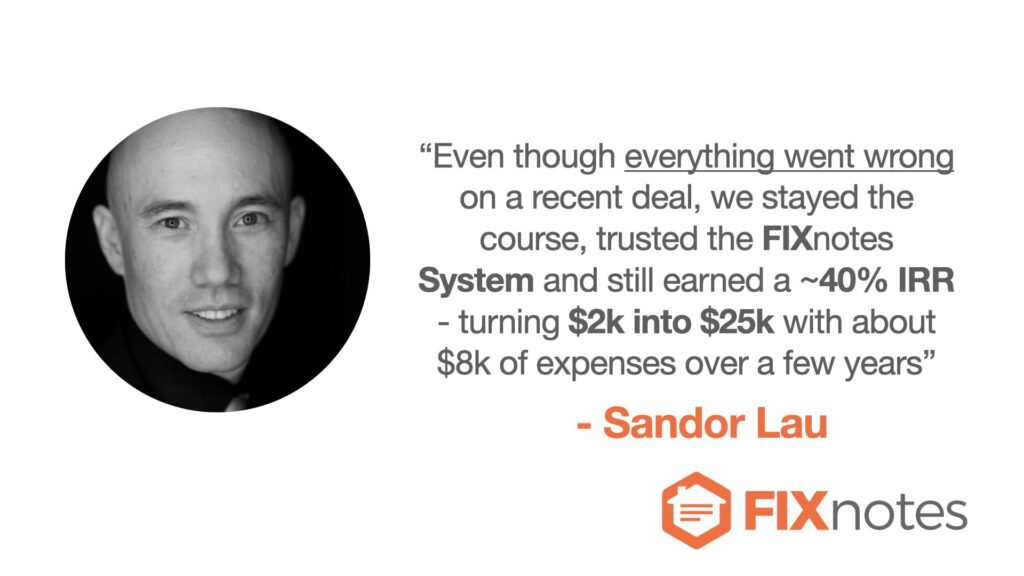

Success Story: Even When Everything Goes Wrong, the System Still Wins

Sandor Lau recently closed a deal where everything went wrong – unexpected delays, expenses, legal hurdles, and more.

And yet, by following the FIXnotes System, he still earned a 40% IRR, turning $2,000 into $25,000 – with about $8,000 in expenses over a few years.

Most investors would have lost money on a deal like this. But with a proven system, he still came out ahead.

This is why mortgage note investing works – and why following a structured roadmap is the key to success.

You Don’t Have to Figure This Out Alone

In this module, I’ve laid out our framework for a machine for sourcing, analyzing, acquiring, and managing mortgage notes.

The only question is:

Are you going to try and build it all yourself – or follow a system that’s already proven to work?

In the next module, we’ll show you how to ensure your machine never runs dry – so you always have a pipeline of high-quality deals. And I’ll extend a special opportunity for you to work with me personally to get your Note Investing Machine set up correctly. So click NEXT and let’s proceed.