The Real Challenge in Investing Isn’t Capital – It’s Consistent Deal Flow

Most real estate investors believe that raising capital is the hardest part of the business. But the truth?

Capital is a commodity. There is more money looking for good investments than there are good investments available.

The real challenge, the thing that separates struggling investors from those who thrive: a consistent pipeline of high-quality opportunities.

Without deal flow, your business stalls – and you waste time chasing cold leads, waiting for brokers to send scraps, or endlessly networking without results.

And we know this firsthand.

When we started sourcing for US Mortgage Resolution, finding deals was our biggest struggle. We tried everything:

- Cold outreach – Sending thousands of mailers and emails, hoping for a response.

- Conferences and networking events – Shaking hands, meeting brokers, waiting for opportunities.

- Joining every organization – Trying to “get in” with the right people.

- Endless follow-ups – Building relationships one conversation at a time.

And while some of this worked, it was slow, inconsistent, and exhausting.

We needed a better way – a system that would allow us to secure reliable, high-quality deal flow without constantly hunting for the next opportunity.

After years of testing, refining, and perfecting, we figured it out.

The New Way: A System That Delivers Deals to You

Through trial and error, we developed a reliable, repeatable process for finding, nurturing, and converting note sellers into long-term deal sources.

And here’s the best part:

Once we figured it out, it worked not just for us, but for anyone we taught the system to.

One of our team members, Mario, learned this process so well that he was able to leave US Mortgage Resolution and start sourcing note deals directly from local credit unions – all by himself.

Now, instead of chasing deals, we have a system that brings deals directly to us.

And we’re going to show you exactly how it works.

1. Build the Right Seller Relationships Once – Get Deals for Years

Most investors waste time chasing individual deals – we take a different approach.

Instead of treating every deal as a one-time win, we focus on establishing relationships with repeat sellers – building pipelines of ongoing opportunities.

The key to this strategy? Positioning yourself as the ideal buyer.

Why Most Investors Struggle to Build Deal Flow

Many investors approach note sourcing the wrong way:

- They cold call banks and hedge funds without any prior connection – making them easy to ignore.

- They blast out generic emails that don’t stand out from the hundreds of other buyers flooding a seller’s inbox.

- They jump from one-off deal to one-off deal, never securing a reliable pipeline of future opportunities.

The result?

- Inconsistent deal flow – some months they’re flooded with opportunities, others they’re completely dry.

- Bidding wars – competing against dozens of buyers on public listings with little pricing power.

- Missed opportunities – because the best deals often never hit the open market in the first place.

If you’re only looking for individual deals, you’re constantly playing catch-up.

The most successful note investors don’t just look for deals – they build long-term seller relationships.

The Right Way: Become a Trusted Buyer, Not Just Another Investor

Our approach is simple: we don’t chase deals – we attract them.

By establishing credibility and trust with sellers, we ensure that they bring opportunities to us first.

Here’s how:

1. Focus on Relationship-Based Deal Flow, Not Just Transactions

Instead of blindly reaching out to sellers asking for available inventory, we position ourselves as valuable partners.

- We learn what they need – whether it’s clearing bad assets off their books, offloading non-core portfolios, or meeting quarterly liquidity targets.

- We offer solutions – helping them structure sales in ways that meet their objectives.

- We become a consistent presence – checking in, offering insights, and staying top-of-mind.

Over time, this shifts the dynamic.

Instead of us asking if they have anything for sale, sellers reach out to us first – because they know we’re reliable, professional, and easy to work with.

2. Secure Forward Flow Agreements for Predictable Inventory

Most investors scramble to find deals one at a time – but the real key to sustainable deal flow is securing forward flow agreements.

These are pre-arranged agreements where sellers agree to offer assets on an ongoing basis, rather than as one-off transactions.

Why is this so powerful?

- You skip the competition – getting first access to assets before they hit the open market.

- You reduce your sourcing time – since new deals are automatically sent your way.

- You create long-term consistency – knowing that fresh inventory is always coming in.

Many of our best relationships started with just one trade – but by proving ourselves as strong buyers, we turned them into ongoing pipelines that have lasted for years.

3. Target the Right Sellers, Not Just the Biggest Ones

Most investors make the mistake of only chasing the big banks and institutional sellers.

But in reality, the best opportunities often come from smaller, more motivated sellers – who are eager to offload assets but don’t want to deal with major brokers or auction platforms.

Some of our most reliable sources include:

- Regional & Community Banks – These institutions frequently have small batches of non-performing loans they need to sell. Unlike national banks, they’re more flexible and open to direct relationships.

- Credit Unions – They often lack in-house expertise to manage distressed assets, making them excellent sources for well-secured, mismanaged notes.

- Private Equity & Fund Managers – These groups sometimes sell off underperforming segments of their portfolios, presenting unique buying opportunities.

- Hedge Funds & Private Sellers – Some hedge funds and private note holders sell loans simply to rebalance their portfolios or raise capital.

By targeting the right sellers, we ensure we’re working with the most motivated, relationship-driven sources.

The Result? A Constant Flow of Deals Without Cold Calling or Chasing Brokers

By focusing on relationship-building instead of one-off transactions, we’ve built a system where sellers actively bring us opportunities – before anyone else even knows about them.

Instead of:

❌ Scrambling to find new deals every month…

❌ Fighting through bidding wars…

❌ Wasting time chasing leads that go nowhere…

We enjoy:

✅ Consistent, predictable deal flow

✅ Early access to high-quality inventory

✅ Deals tailored to our exact criteria

And now, we train our members to do the same.

But building strong seller relationships is only part of the equation- you also need a system to manage and organize these opportunities so nothing falls through the cracks.

4. Turning Seller Interest into a Consistent Deal Flow System

Building strong seller relationships is only part of the equation—you also need a system to manage and organize these opportunities so nothing falls through the cracks.

One of the biggest mistakes investors make? They don’t have a structured way to capture and follow up with sellers.

Think about it:

- You spend months networking, attending conferences, and making connections… but when a seller is finally ready to move assets, do they know how to reach you?

- You have an email thread going with a potential seller… but weeks go by, and you forget to follow up.

- A hedge fund reaches out about a bulk sale… but you’re scrambling to organize notes, track conversations, and remember pricing details.

Without a clear process, deals slip through the cracks.

That’s why every serious investor needs a central hub – a dedicated place where sellers can easily connect, and where deals can be tracked and nurtured over time.

For some investors, this means hiring an assistant to manually log emails and manage seller outreach.

For others, it means setting up a CRM (customer relationship management system) to track every conversation and ensure follow-ups happen on schedule.

And for note investors who want a turnkey system designed specifically for this business, there’s the Deal Source Dashboard (DSD).

The Deal Source Dashboard: A Complete Seller Management System

Now I’m going to show you this as an example of what you’ll want to set-up for your business (and at the end of this Roadmap, an opportunity to clone it right into your own business).

So instead of manually tracking conversations or losing deals due to lack of organization you’ll want a structured, automated approach to deal flow management.

Make sure to check these boxes:

✅ A professional seller landing page – A simple, optimized website where sellers can submit deals directly to you, instead of relying on emails and phone calls.

✅ An automated backend CRM – Every seller inquiry is logged, tracked, and organized so you never lose sight of a potential deal.

✅ Built-in webforms & clear calls to action – Whether a seller wants to submit a deal, a borrower needs assistance, or an investor wants to partner, everything is structured to convert leads into real transactions.

The goal?

To make it as easy as possible for sellers to work with you—so when they’re ready to move assets, you’re the first call they make.

Why Having a System Like This Changes the Game

Attracting and converting Note Sellers is important of course, but your system should also make it as easy as possible for Investors & Borrowers to work with you as well.

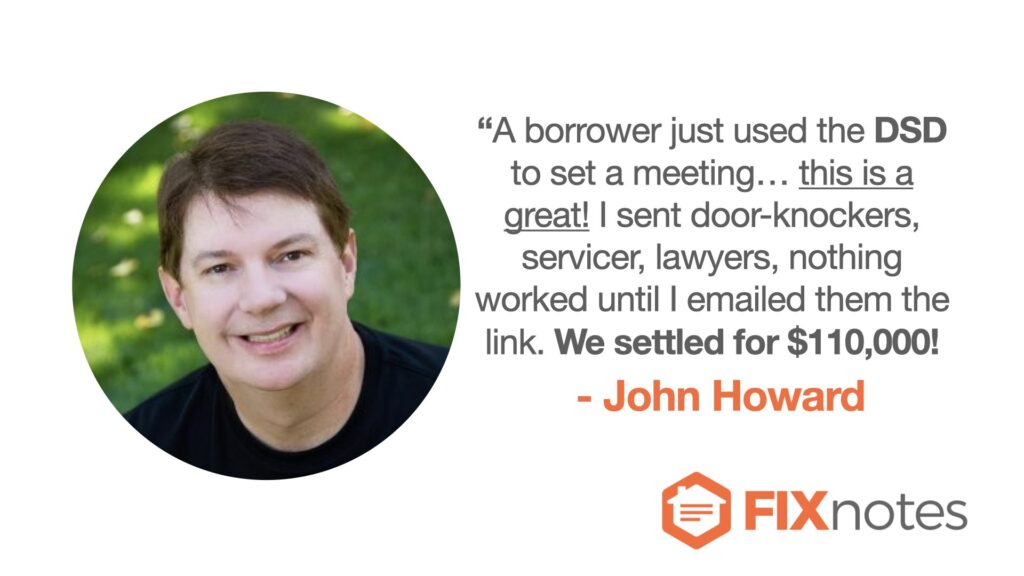

John, one of our members, was working on a non-performing loan where the borrower had ignored every outreach attempt.

❌ He sent door-knockers—no response.

❌ His servicer contacted them—ignored.

❌ Attorneys got involved—still nothing.

Then he emailed them a simple link to his Deal Source Dashboard.

Within minutes, the borrower scheduled a meeting.

A few weeks later?

💰 He settled the loan for $110,000.

When you have a system in place, deals don’t get lost, follow-ups happen automatically, and sellers know exactly how to reach you.

This isn’t about fancy tech—it’s about making deal flow effortless.

Whether you build your own system or use a done-for-you version like the Deal Source Dashboard, the key is having a structured way to capture, track, and convert seller relationships into consistent deal flow.

But sending seller traffic to your Deal Source Dashboard requires some work. What if you want deal flow delivered to your desk on a silver platter…

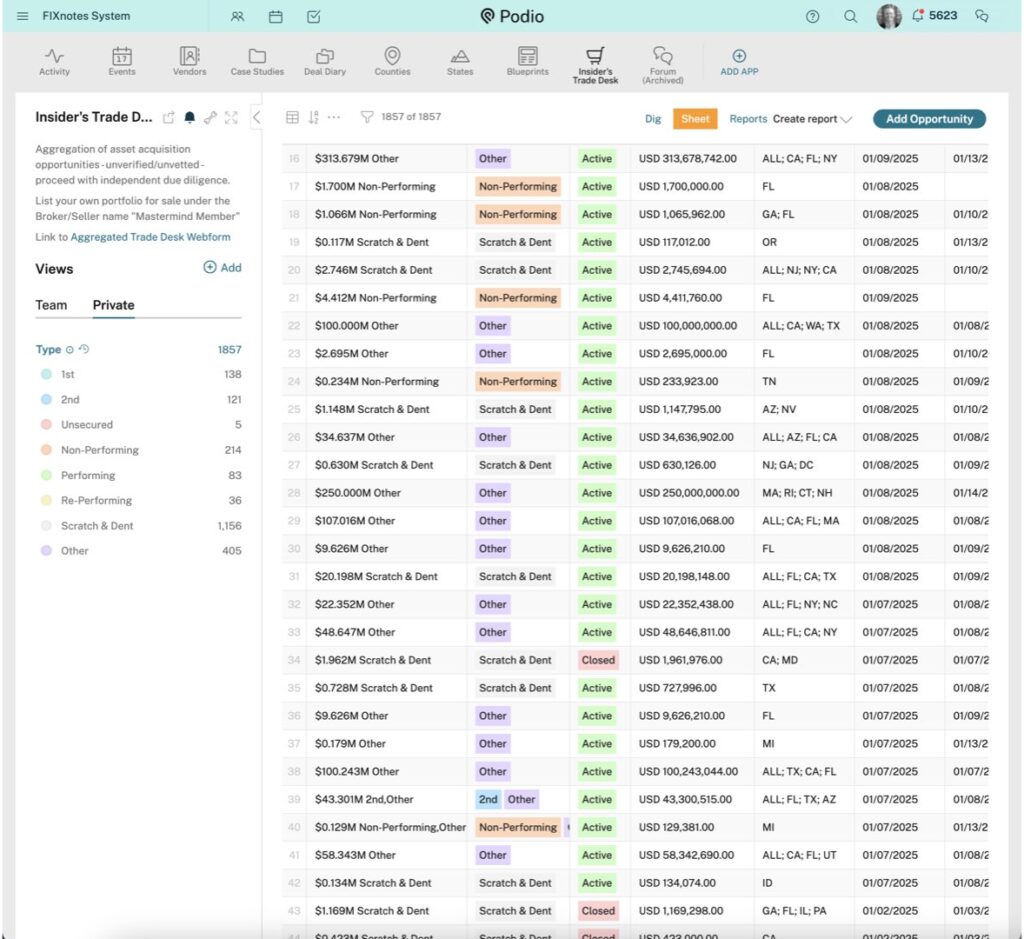

Introducing The Insider’s Trade Desk – Your Instant Access to Thousands of individual Loans & portfolios for sale

Most investors struggle to find a steady supply of quality notes because they don’t have direct access to sellers.

That’s why we created the FIXnotes Insider’s Trade Desk—a private platform where thousands of individual assets and portfolios have been listed.

- Every time a seller, broker, or loan-sale advisor emails us a deal, it’s automatically added to the Trade Desk.

- As soon as we see it, you see it. You can reach out to sellers directly, build your own relationships, and close deals.

- We never charge transaction fees for buyers. These opportunities are handed to you on a silver platter.

And now, the Insider’s Trade Desk puts you in that position, automatically.

Exclusive Buying Opportunities Direct From Portfolio Managers

Beyond the Trade Desk, we also connect our clients with exclusive access to institutional portfolios.

Our portfolio management clients, like US Mortgage Resolution, consistently offer assets for sale, exclusively available to our community.

- At least $1 million in loans is listed every other month.

- No minimum trade size – cherry-pick individual assets to start small.

- We’ve closed trades as small as $400 and as large as $4 million.

For new investors, this is the perfect way to get started – accessing institutional-quality deals without needing to buy in bulk.

And for experienced investors? It’s a direct line to inventory you won’t find anywhere else.

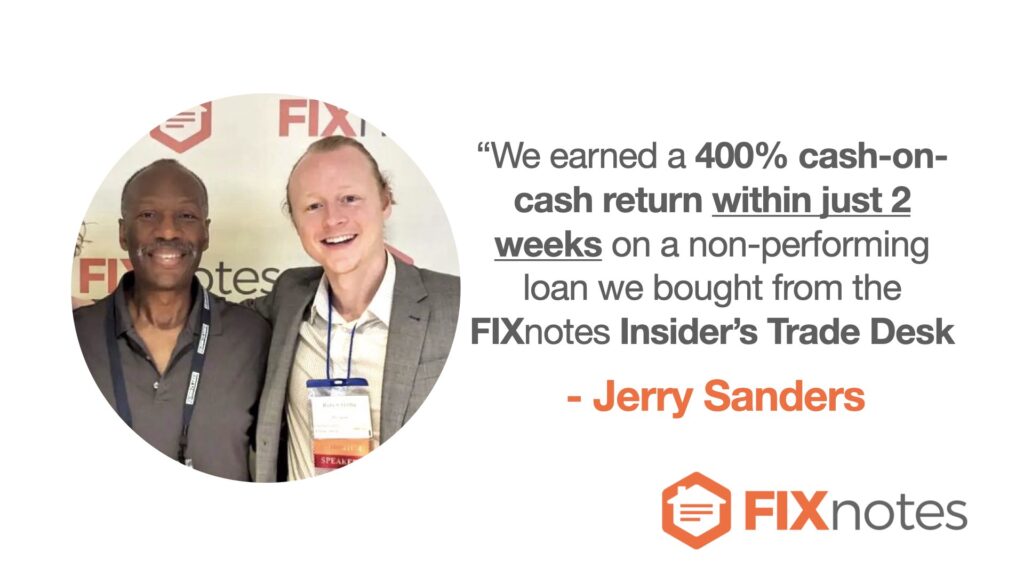

Example:

Jerry sourced a non-performing loan from the Insider’s Trade Desk, closed the deal, and walked away with a 400% cash-on-cash return in just two weeks.

Does that happen every time? No. But these kinds of opportunities don’t exist unless you’re in the right place at the right time.

The Deal Flow System That Never Runs Dry

When you have the right deal flow system, you’re no longer at the mercy of brokers, cold calling, or outdated marketing tactics.

- You build real seller relationships that provide opportunities for years.

- You get instant access to the Insider’s Trade Desk, where thousands of assets are listed.

- You tap into exclusive buying opportunities from portfolio managers.

- You automate your own inbound deal flow with the Deal Source Dashboard.

This is how top note investors ensure their Machine never runs dry.

Next Steps To Implement The $1,000,000 Real Estate Roadmap

Now you know the Three Paths to Building Wealth with Notes, the steps to create your Modular Note Investing Machine and how to create Consistent, Predictable Deal Flow. What’s next? You need to take action to grow your portfolio and scale your income!

I’ve put together a special offer for alumni of the Roadmap to get the tools, comprehensive training & support they need to reach the $1,000,000 goal in the next 12 months. The complete FIXnotes System to implement the Roadmap without trial & error.

I’ll be sharing your private invitation for this special offer on a short webinar you can register for now. This is a chance to work with me personally to build your Note Investing Machine.