The Traditional Real Estate Trap vs. The Smarter Alternative

You’ve Been Sold the Wrong Real Estate Roadmap!

If you’ve spent any time learning about real estate investing, you’ve probably heard that the path to wealth is through:

- Owning rental properties

- House hacking

- Flipping homes

- Wholesaling deals

- Running short-term rentals

- BRRRR

But here’s the truth: these strategies are slow, stressful, and unpredictable.

Most investors think they’re following a roadmap to financial freedom, but in reality, they’re on a never-ending treadmill of problems, debt, and headaches.

- Owning rental properties? You’re a full-time landlord, managing tenants, broken toilets, and maintenance issues.

- House Hacking? Good luck finding the perfect duplex or multifamily to make it work.

- BRRRR or Flipping? You’re constantly at the mercy of contractors, unexpected expenses, and a shifting market.

- Wholesaling? You’re hunting for desperate sellers, relying on their misfortune to turn a profit.

- Short-term rentals? You’re not an investor—you’re a hotel manager, dealing with guests, reviews, and local regulations.

And let’s not forget the ethical problem behind most of these strategies:

- Wholesaling only works if sellers agree to take far less than their property is worth.

- Rentals push homeownership further out of reach by turning houses into investment properties.

- Flipping thrives on distressed neighborhoods, but often displaces long-time residents.

Sure, these models can make money – but at what cost? Your time, your stress levels, and in some cases, your integrity.

Now, ask yourself this:

If real estate investing is supposed to be the path to freedom…

Why does it look so much like another full-time job?

The Real Estate Shortcut That Banks Have Used for Centuries

The biggest lie in real estate investing is that you have to own properties to build wealth.

It’s simply not true.

Think about how banks operate:

- They make billions from real estate – often without ever owning a single property.

- They collect mortgage payments every month – without dealing with tenants or maintenance.

- They don’t flip houses, manage Airbnbs, or chase deals.

Instead, they own the debt behind the real estate. Pulling the strings, controlling the deals & rarely facing any of the liability or consequences.

This is the hidden shortcut to building wealth – because it allows you to profit from real estate without the headaches of owning it.

And here’s the best part: you don’t need to be a bank to do this.

With the right strategy, you can step into the bank’s position and build wealth on autopilot.

Welcome to Mortgage Note Investing – The Smarter, Stress-Free Way to Build Wealth

Instead of owning property, note investing allows you to own the mortgage itself.

Instead of being a landlord, you become the lender – which means:

- You collect monthly payments – without tenants, maintenance, or evictions (the owner of the property is responsible for all that).

- You don’t chase deals or have to convince sellers to take a loss (if the home value decreases, it’s the owner’s problem)

- Your investment is secured by real estate – but without the stress of owning or managing it (the home owner works for you)

This isn’t a theory – it’s exactly what banks have been doing for centuries.

Banks don’t fix toilets, deal with vacancies, or worry about evictions. They just collect money.

Now, with the right strategy, you can do the same.

And unlike traditional real estate investing, this model is scalable, ethical, and recession-resistant.

- It’s scalable. A nationwide operation can be run from your home office or wherever you have internet connection & a laptop.

- It’s lucrative. One good note deal can be worth multiple rental units in cash flow – without needing to manage properties.

- It’s ethical. Instead of displacing homeowners, you’re often helping them stay in their homes with a win-win solution.

- It’s recession-proof. No matter what the housing market does, debt purchased at a deep discount retains it’s value. In fact, distress and recession means more opportunity.

This is the smarter roadmap to building wealth.

And in this Module, I’m going to show you exactly how it works and how you can start profiting from it.

Let’s get started.

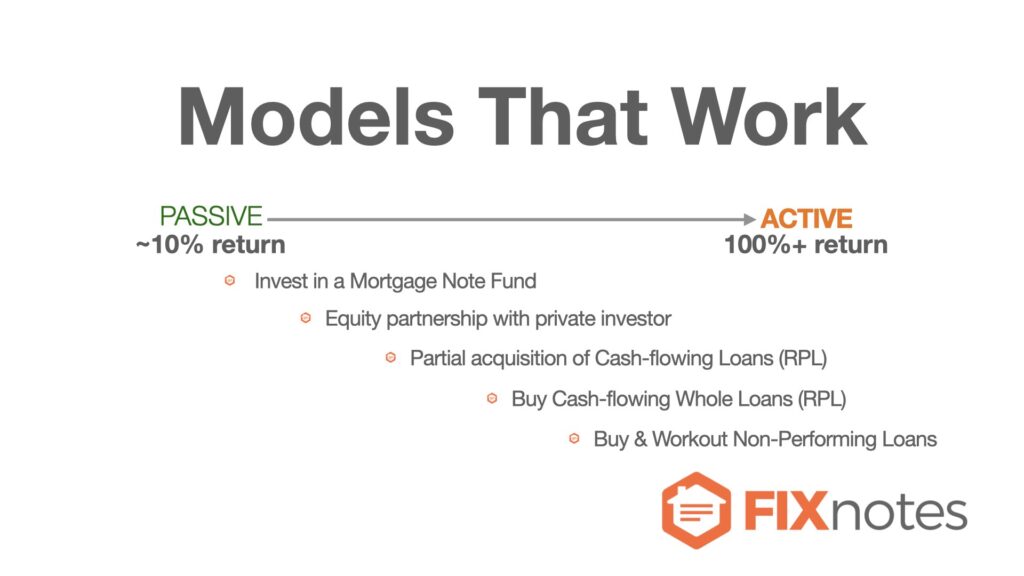

Choose Your Income Strategy – The Opportunity Compass

Simplified: Three Paths to Profiting from Notes

Not all mortgage note investors follow the same path. Your starting point depends on two things: your financial situation and your lifestyle goals.

- Do you want steady, passive income without daily involvement?

- Do you want higher returns in exchange for taking a more active role?

- Or do you want to start making money without investing any of your own capital?

No matter where you are right now, there’s a way to profit in this industry.

Here are the three primary paths to making money with mortgage notes – and how to pick the one that’s right for you.

Path 1: Passive Income with Performing Notes

(Cash Flow Without the Work)

If you want a completely hands-off income stream, buying performing mortgage notes (where homeowners are already making payments) is the simplest and safest way to start.

You’re not managing properties.

You’re not dealing with tenants or repairs.

You’re simply collecting monthly payments—just like a bank does.

How It Works:

- Find and buy a performing note from a lender or investor.

- The homeowner keeps making payments – to you.

- Your loan servicer handles everything (paperwork, collections, etc.).

- You collect cash flow every month – without lifting a finger.

- When the borrower pays off the loan, you receive a final lump sum.

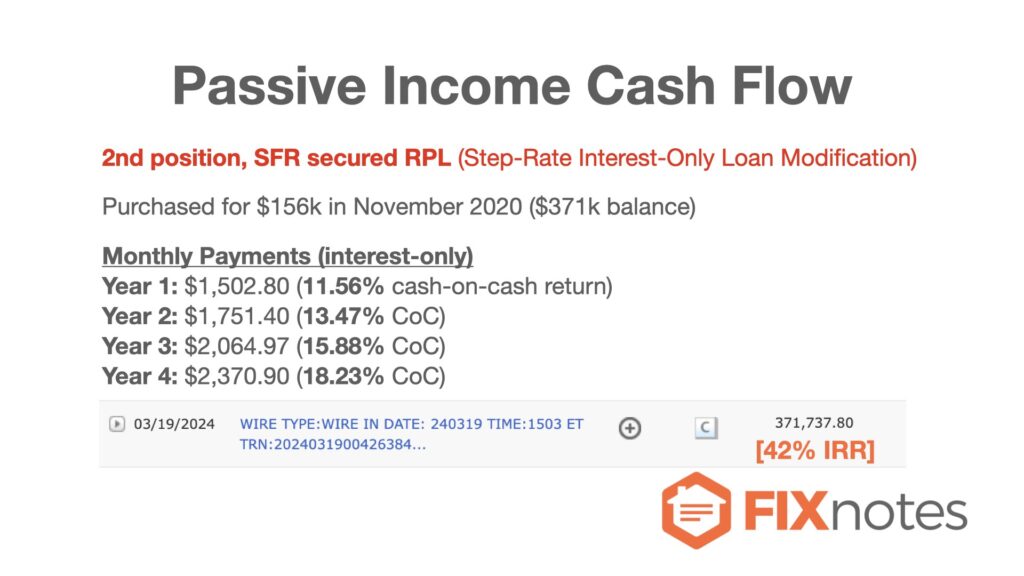

Example:

Here’s a cash-flowing mortgage note I bought for $156,000. The borrower paid ~$2,000 per month for 3.5 years. Eventually, they refinanced, and I received a final payoff of ~$371k – without managing a single tenant or fixing a single broken toilet (more profitable than all of my rental properties combined).

Here’s a cash-flowing mortgage note I bought for $156,000. The borrower paid ~$2,000 per month for 3.5 years. Eventually, they refinanced, and I received a final payoff of ~$371k – without managing a single tenant or fixing a single broken toilet (more profitable than all of my rental properties combined).

Who is This For?

- Investors who have capital to deploy and want passive cash flow.

- Real estate investors who want consistent income – without property headaches.

Path 2: Active Wealth with Non-Performing Notes

(Higher Profits, More Involvement)

If you want higher returns and enjoy solving problems, you can buy non-performing mortgage notes—loans where the borrower has stopped making payments.

Because these loans are distressed, you can buy them at deep discounts—often for 50 cents on the dollar or less.

Then, you have three ways to profit:

- Modify the loan – Give the homeowner a second chance, turn it into a performing loan, and keep collecting payments.

- Negotiate a lump-sum settlement – The borrower pays a reduced amount to settle the debt.

- Foreclose and sell the property – If the borrower doesn’t pay, you take back the property at a discount.

Example Deal:

Watch the video above for a case-study from DJ who made a 600%+ return fixing & flipping a non-performing note.

Who is This For?

- Investors who want higher returns and don’t mind being more active.

- Real estate entrepreneurs who enjoy structuring deals & creating win-win solutions.

Path 3: Starting with No Capital

(Earning Without Investing)

What if you don’t have capital to invest yet?

Good news: you don’t need money to make money in this industry.

There are two powerful business models to generate immediate income from mortgage notes without risking a dime of your own money.

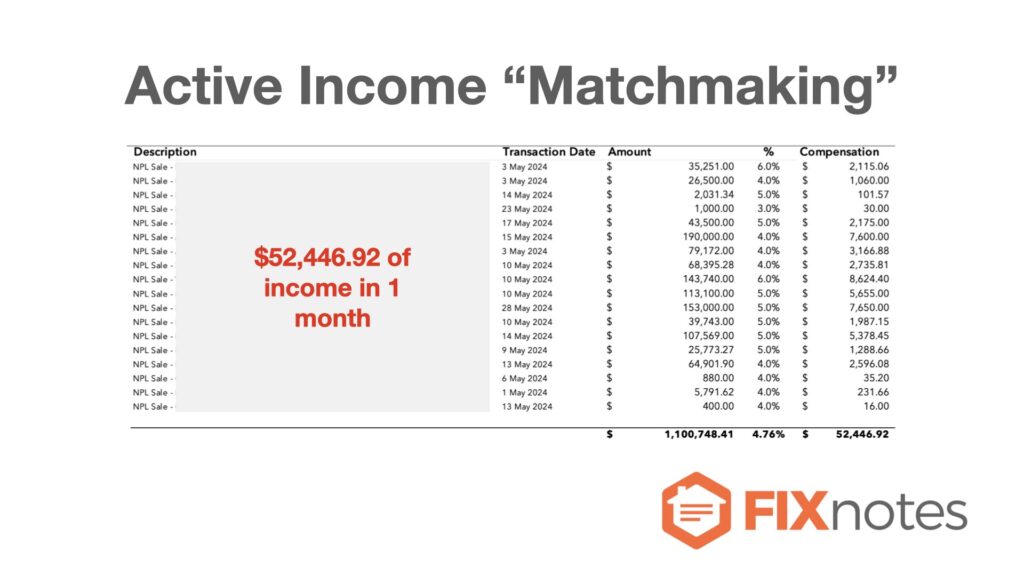

⚙️ Model 1: The Mortgage Note Matchmaker (Earn Fees by Connecting Buyers & Sellers)

Every day, banks, hedge funds, and distressed debt sellers look to offload their mortgage notes. And every day, investors are looking to buy them.

But there’s a problem: these two sides don’t always know how to find each other.

That’s where you come in.

As a Mortgage Note Matchmaker, you act as the middleman – connecting sellers with buyers and earning a fee on every transaction.

You don’t need to invest.

You don’t need to take on risk.

You just connect the right people and get paid.

Example:

Here’s one month of matchmaking deals that earned us $52,446.92 in commissions – without buying a single note. Simply connecting our seller clients with buyer’s in our community.

Who is This For?

- Anyone who wants to start earning in real estate without investing money.

- Entrepreneurs who are good at networking, sourcing deals, or bringing people together.

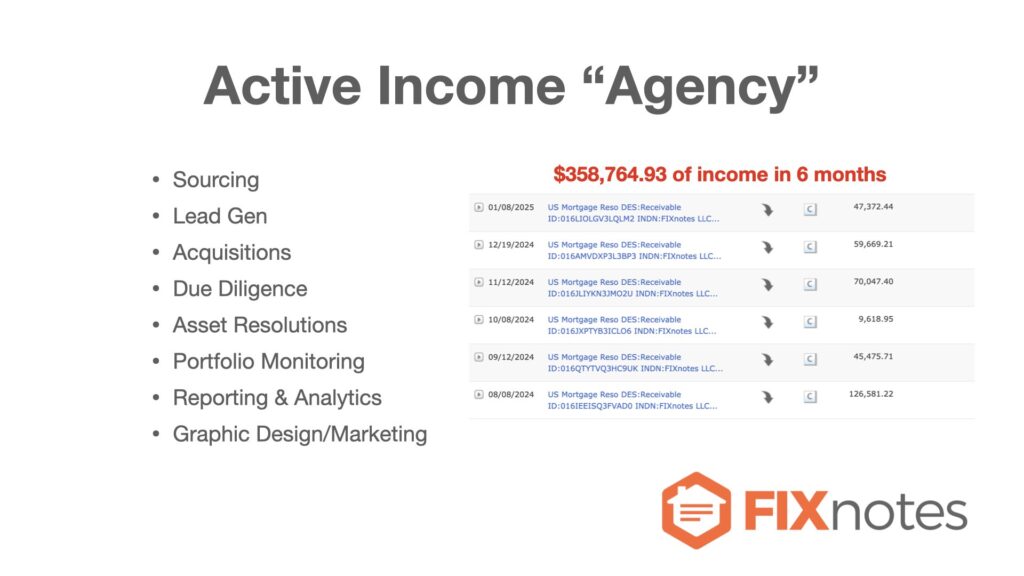

⚙️ Model 2: The Mini-Agency for Note Investors (Get Paid to Provide Services in the Industry)

The mortgage note industry needs specialists – people who can help investors analyze deals, source opportunities, manage transactions & more.

Smart investors know how to delegate, often don’t want to handle the details – and they’re willing to pay you to do it for them.

That’s why starting a Mini-Agency for Note Investors is one of the fastest ways to make money in this business, while building your skills – without investing your own capital (earn & learn).

Services You Can Offer as a Mini-Agency:

- Sourcing & Lead Gen – Finding deals & note sellers.

- Acquisitions – Managing logistics of servicing transfers.

- Due Diligence – Analyzing deals for investors.

- Asset Resolutions – Helping investors turn non-performing loans into profitable assets.

- Portfolio Monitoring & Servicing Oversight – Ensuring borrowers keep paying.

- Marketing & Branding – Helping investors raise capital and build their brands.

Example:

This is an inside look at 6 months of income (over $350,000 from just one client) that I earned personally by providing due diligence, portfolio management and other services.

Who is This For?

- Entrepreneurs who want to learn while earning.

- People who don’t have capital but want to get into the industry.

- Service providers who can offer value to investors in exchange for fees.

Which Path Will You Take? Follow the Opportunity Compass

No matter where you’re starting from, there’s a way for you to profit in this industry:

- If you have capital and want passive income: Buy performing notes and collect cash flow without the work.

- If you want bigger returns and don’t mind being active: Buy non-performing notes and create your own value.

- If you don’t have capital but want to start making money today: Earn transaction fees as a Mortgage Note Matchmaker or build a Mini-Agency for Note Investors.

This is not a one-size-fits-all business.

It’s a modular system that allows you to start where you are and scale up over time.

- The system you develop as a Mortgage Note Matchmaker turns into the Acquisition Process you build your own portfolio with.

- The services you provide as a Mini-Agency are the processes you’ll put together into your Note Investing Machine

Unlike traditional real estate – you & your clients in the industry are not tied down by tenants, repairs, or endless property management headaches.

You own the debt – not the problems.

Now that you see the three paths to profit, it’s time to dive deeper into how to find the best deals – so you always have opportunities waiting for you.

We’ll cover that in Module #4.

Stack Your Income Streams for Maximum Wealth – Your Roadmap 🗺️

Most investors limit themselves to one real estate strategy – flipping houses, buying rentals, or wholesaling deals.

But the most successful investors don’t rely on just one income stream.

They stack multiple income streams to create a self-sustaining system – one that generates consistent cash flow, builds long-term wealth, and allows them to scale without limits.

With mortgage note investing, you have the unique ability to layer different strategies together – starting with zero capital if needed and building up to a 7-figure portfolio.

Here’s how you do it:

Step 1: Start by Generating Cash Flow Without Risk

If you’re starting with little to no capital, your first move is to create immediate income – without putting your own money on the line.

That means:

- Earning fees through mortgage note matchmaking (connecting buyers & sellers).

- Providing high-value services as a Mini-Agency for Note Investors (helping investors source, analyze, or manage deals).

This is where you build your foundation.

You’re getting paid while learning the business, and you’re setting yourself up for bigger opportunities down the road.

Once you have steady income flowing in, it’s time to level up.

Step 2: Use Your Earnings to Buy Your First Passive Income Notes

The biggest mistake most new investors make?

They spend their earnings on lifestyle upgrades instead of assets that produce cash flow.

Instead, take the fees you’ve earned from matchmaking or agency work and buy your first performing mortgage note.

Why?

- It locks in long-term passive income.

- It shifts you from earning transactional money to building wealth & gives you the confidence to go to the next level.

- It gives you financial leverage to scale up into bigger deals.

This is your first major wealth-building milestone – you now own an asset that pays you every month without your active involvement.

At this point, you have cash flow coming in and capital growing.

Now, you’re ready to go after bigger profits.

Step 3: Scale Up with Non-Performing Notes for Larger Profits

With your foundation in place, it’s time to start playing the bank’s game.

By reinvesting some of your earnings into non-performing notes, you’re now buying distressed debt at huge discounts – which means:

- You control the terms. Modify the loan and create even more cash flow.

- You can take quick profits. Negotiate a settlement and get paid upfront.

- You can acquire real estate at a steep discount. If a borrower can’t pay, you foreclose and take ownership.

This is where your returns skyrocket.

By layering non-performing note deals into your portfolio, you multiply your profits and cash flow – without ever managing tenants or rehabbing properties.

Step 4 (optional): Raise Capital & Scale to a 7-Figure Business

Once you’ve mastered the process, the final step for the most ambitious is to scale your operation by leveraging other people’s money.

- Bring in private investors or institutional financing to fund larger note purchases.

- Expand your deal flow so you have a constant pipeline of opportunities.

- Create partnerships to acquire more notes and grow your portfolio.

At this level, you’re no longer just an investor – you’re building a scalable real estate business that runs without you.

This is how you reach 7-figures in mortgage notes quickly.

Your Roadmap to Real Estate Wealth Starts Now

You now have a clear path to start building wealth with mortgage notes:

- Zero-risk cash flow through note matchmaking & mini-agency services. (Get paid without investing capital)

- Passive income through performing notes. (Consistent, hands-free cash flow)

- Bigger profits through non-performing notes. (Higher returns, more control)

No matter where you’re starting, you can build wealth in real estate – without the stress, risk, and headaches of property ownership.

Let’s keep going – click NEXT below and get the Roadmap to Build your Modular Note Investing Machine.