In real estate, you make money when you buy. Conducting comprehensive due diligence is the most important step in the acquisition process. Even a small oversight in DD can create DISASTROUS ripple effects down the road.

Even when you have it right, airtight research & analysis won’t protect you from faulty collateral. A perfect note on the seller’s tape without original, enforceable documents might be worth nothing.

Everyday, files are traded around the secondary market with original documents in disarray, missing proper endorsements, servicing records or RESPA procedure.

![]()

Whether you’d like to maximize the value of your portfolio or analyze notes for sale, FIXnotes research, analytics & data design will take your investing career to the next level.

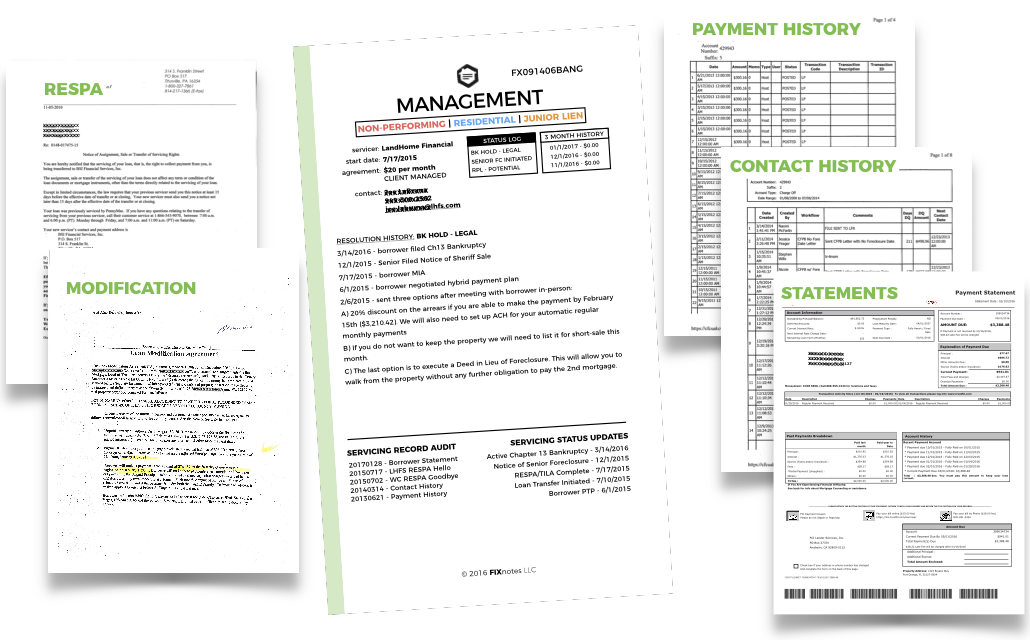

Our flagship offering [in development] combines a suite of resources into FOUR CORE REPORTS to comprehensively review & refine your asset into actionable, decisive intelligence. Each one-page, legal sized (11″x14″) report serves as a summary divider for your original collateral, vendor research, servicing files & legal documents.

Starting with our signature legal sized summary page outlining your investment, this is where you’ll find your expected yield, equity & critical status flags followed by verification of enforceable, original documentation.

Enclosed you’ll find updated title, property value, tax, credit & skip trace. Aggregated data is calculated into an estimated market value for your asset.

Review the raw data & vendor reports included or simply check out the summary page to “look under the hood without getting your hands dirty.”

Included within this section are your borrower’s payment, contact history, resolution agreement, proof of insurance, authorizations & most recent statements. We’ll communicate with your servicer to get all the details, then share our findings with you.

Every FIXnote includes an organized review of all your critical legal situations. After you connect us directly with your legal counsel, we’ll talk shop and summarize the situation in the simplest terms, preparing you for action.

$$397

The owner's guide for your specific asset. Eliminate Uncertainty - Maximize Value

INCLUDED:

ASSET VITALS – snapshot details, metrics & collateral audit

DUE DILIGENCE – your data, reviewed & analyzed + loan price estimate

MANAGEMENT – servicing history, status updates & record review

LEGAL + BANKRUPTCY – legal updates, document audit

OPTIONAL UPDATES

For the comprehensive review, we’ll need updated data. If you don’t have recent vendor reports already, we’ll order them for you!

TITLE REPORT

BROKER’S PRICE OPINION

CREDIT REPORT

SKIP TRACE

This can be used all at once or over the course of the 30 days following your order delivery. Here’s an idea of what to expect from your FIXnotes expert Rob:

What is a Note?

If you’re just getting started in the mortgage note business, the best place to start is with our free online course: How to Invest in Mortgage Notes

What do you need from me to create my FIXnote?

Great question, the more data the better! Here are some items to get started:

What if I don't have any data?

At the bare minimum, we’ll need the loan data tape (an Excel file with the relevant loan details). Without updated vendor reports, the resulting FOUR CORE REPORTS won’t be as effective.

If you don’t have BPO, Title, Credit or Skip Trace (updated within the last ~6 months), we strongly encourage you to add updated data options at checkout.

What if I don't own the loan already?

If you have permission from the asset owner to communicate with the loan servicer & legal counsel and written authorization to pull credit & run a skip trace, we’re all set!

If you’re missing any of these authorizations we can still proceed but your data will likely be incomplete (unless the seller has provided servicing records & updated vendor data).

When will I receive my completed order?

As FIXnotes is still in development, new orders aren’t expected to be completed for up to 2 weeks.

Once an order is complete, you’ll first receive a PDF delivery by email. You’ll have 48 hours to review & make any changes before the documents are printed and shipped!

You didn't answer my question.

I just want to buy loans

Rob is hard at work on the FIXnotes TRADE DESK.